THE INVESTOR

|

17

25TH ANNIVERSARY

SH

In Europe this was compounded by a second, albeit shallower,

recession in 2011–13, as the nancial crisis exposed strains and

weaknesses in the eurozone.

The scal hangovers, which required governments to impose

austerity measures in order to reduce ballooning budget de cits,

are part of the reason central banks have kept interest rates so

low and engaged in measures such as QE.While governments’

austerity programmes have been suppressing growth, central

banks have been doing their best to keep growth going with ultra-

loose monetary policies.

This may now be coming to an end.Though not all countries

have completed the process of reducing their de cits – the UK is

one of those still going through the process – there is now a sense

that monetary policy has done all that it can, and it is time for scal

policies of spending increases and tax cuts.That will certainly be

the case in Donald Trump’s US and, to a lesser extent, in Europe.

So what will happen? First, central banks will nudge up

interest rates, a process which has already begun in the US and

will gradually spread to other countries.Then they will begin to

reverse QE, which will be a complex process. In the case of the

UK, the Bank of England has bought £435 billion of assets (such

as gilts) and is in the process of buying a further £60 billion

2

. It

has said it will not reverse QE – sell these assets back – until the

interest rate, which is currently 0.25%, has risen to 2%.

The return of interest rates to more normal levels by the end

of the decade, together with the unwinding of QE, will wean

economies o some of the emergency measures that have been

in place since the crisis. Note, however, that things will not be the

same as they were before the crisis.A 2% interest rate compares

with a 5% pre-crisis norm. Economic growth will be subject to

what economists describe as‘headwinds’ and thus be weaker than

it used to be.That long shadow of the crisis will have a darkening

e ect for some time to come.

ICELAND VOLCANIC ASH CLOUD

AND AS IF THINGS WEREN’T BAD ENOUGH,

MOTHER NATURE SHOWS HER FURY...

J

Iceland’s Prime Minister, Geir Haarde,

announced his resignation following his failed

attempts to form a coalition to run the country.

Haarde had been under sustained pressure since

the nancial crisis, which exposed the extent of

Iceland’s debts and over-expansion of its banking

industry.The country’s banks attracted billions

in deposits with interest rates as high as 10%;

when the crash came, it emerged that the debts

of these banks were between six and 10 times the

country’s GDP

3

.

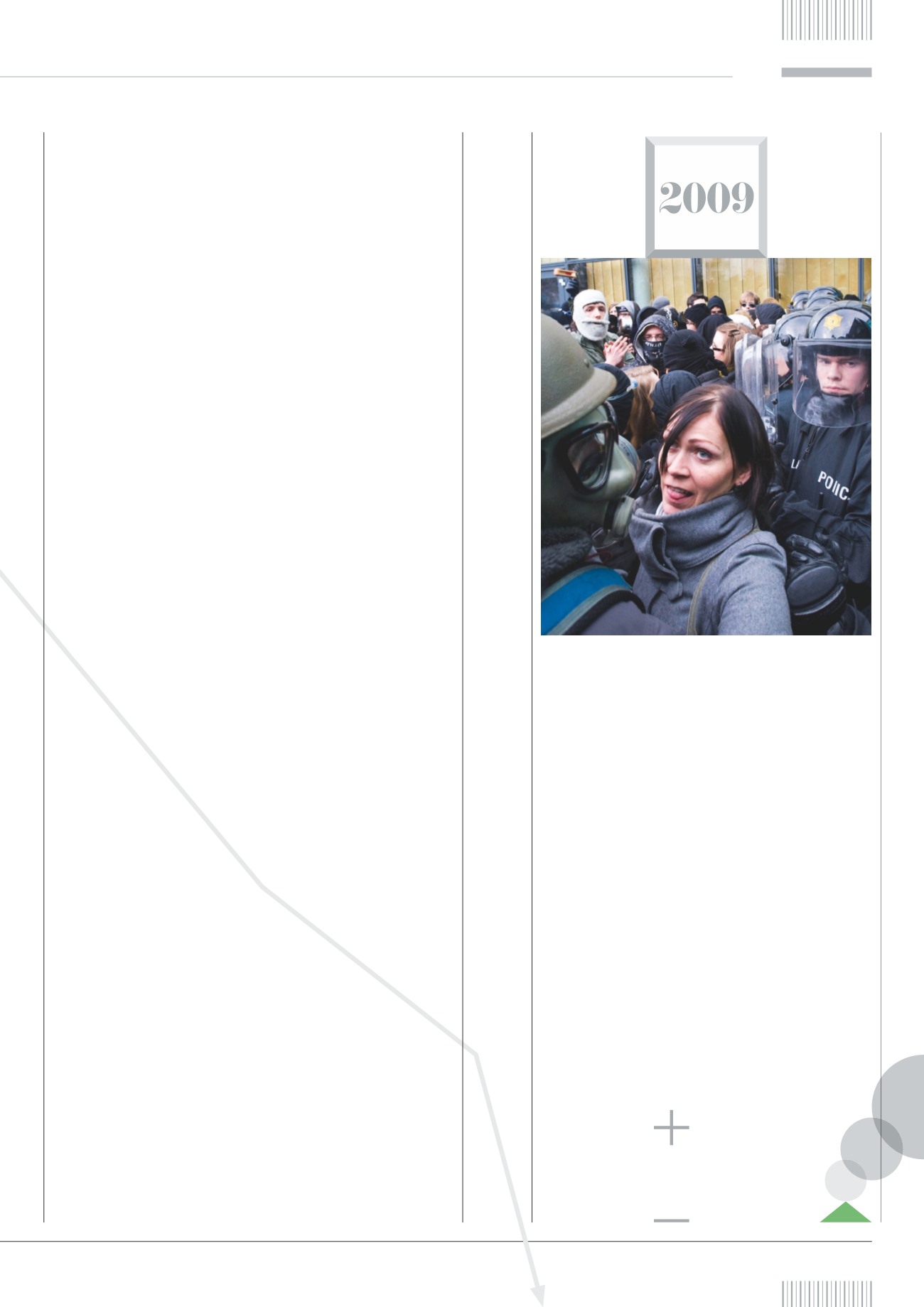

Prime Minister quit as banks that

had once ourished revealed balance

sheets with massive losses

ICELANDIC

COLLAPSE

Icelandic citizens

reacted angrily

to the country’s

financial crisis

1

The Age of Instability

, published 2010; 2 bankofengland.com, August 2016; 3 news.bbc.co.uk, September 2009

1992–2017